While technology has made the job of locating diamond deposits easier and more efficient, prospecting for diamonds is still a costly proposition. And diamond exploration isn’t for the faint of heart. Because of the vast capital outlay needed to find and develop a mine, mining companies need huge financial resources. And they must think of time in terms of decades.

Finding the diamonds is only part of the process. Once prospectors locate a promising area, the mining company must spend additional time and money to develop it. Canada’s Ekati mine took years of exploration to locate, and more than $700 million to develop, but the potential profits are huge. Experts consider Ekati’s unmined diamond reserves to be in excess of $8 billion at current prices, and project a 25-year lifespan for the mine.

There are many places around the planet that might contain diamond deposits, but not all of them do. And not every diamond deposit is valuable enough to develop into a profitable diamond mine. Mining companies must consider several factors when they decide whether or not to develop a mine at a given site.

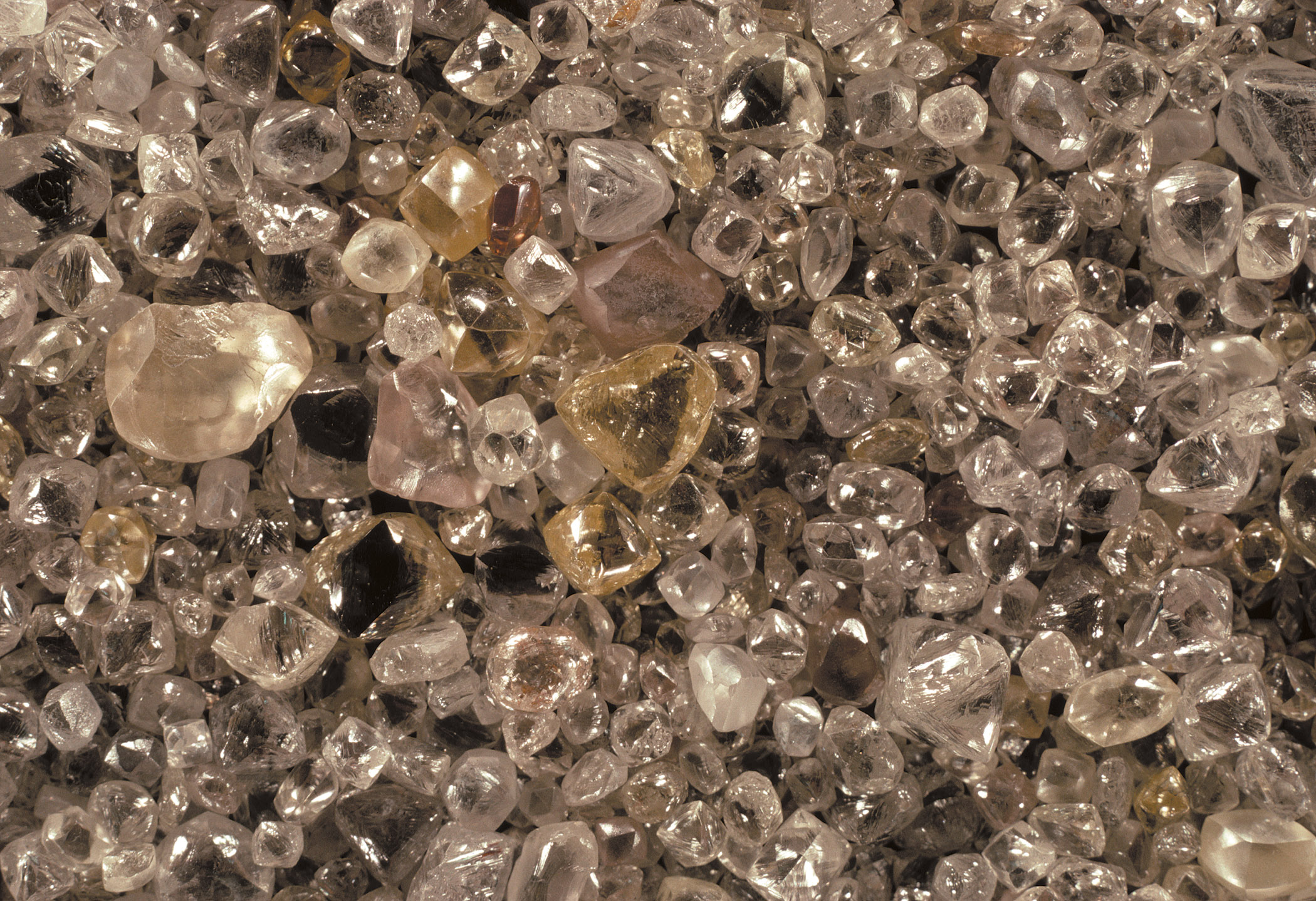

They have to consider how many tons of diamond-bearing rock a deposit might contain, as well as the concentration of diamond rough within the deposit and the size, quality, and value of the diamonds themselves. They also consider the location and accessibility of the diamond deposit as well as the host country’s political stability and legal requirements, like taxes and environmental legislation.

Even the smallest diamond must be located and mined, which represents an enormous investment in time and money. As a result, the costs of finding and mining diamonds are significant factors affecting overall diamond value.